Weak Confluences Prior To Objective

CONCLUSIONS:

- OVERALL: 60% (3:2) & 6.32 R-Multiple.

- Overall: 60% (3:2) & 6.32 R-Multiple.

- Overall:

- Probable Singular Confluence: 50% (1:1) & 0.66 R-Multiple.

- Probable Singular Confluence: 50% (1:1) & 0.66 R-Multiple.

- Probable Singular Confluence:

- Improbable Singular Confluence:

- Improbable Singular Confluence:

- Improbable Singular Confluence:

- Undefined Singular Confluence:

- Undefined Singular Confluence:

- Undefined Singular Confluence:

- Majority Probable Conglomerate: 67% (2:1) & 5.66 R-Multiple.

- Majority Probable Conglomerate: 67% (2:1) & 5.66 R-Multiple.

- Majority Probable Conglomerate:

- Majority Improbable Conglomerate:

- Majority Improbable Conglomerate:

- Majority Improbable Conglomerate:

- Majority Undefined Conglomerate:

- Majority Undefined Conglomerate:

- Majority Undefined Conglomerate:

- Evenly Distributed Conglomerate:

- Evenly Distributed Conglomerate:

- Evenly Distributed Conglomerate:

_______________________________________________________________________________

- 15M ERT Inverse FVG: 0% (0:1) & - 1.00 R-Multiple.

- 15M WG Inverse FVG: 100% (1:0) & 1.66 R-Multiple.

SUPPORTS

TOTALS: 3 & 8.32 R-Multiple.

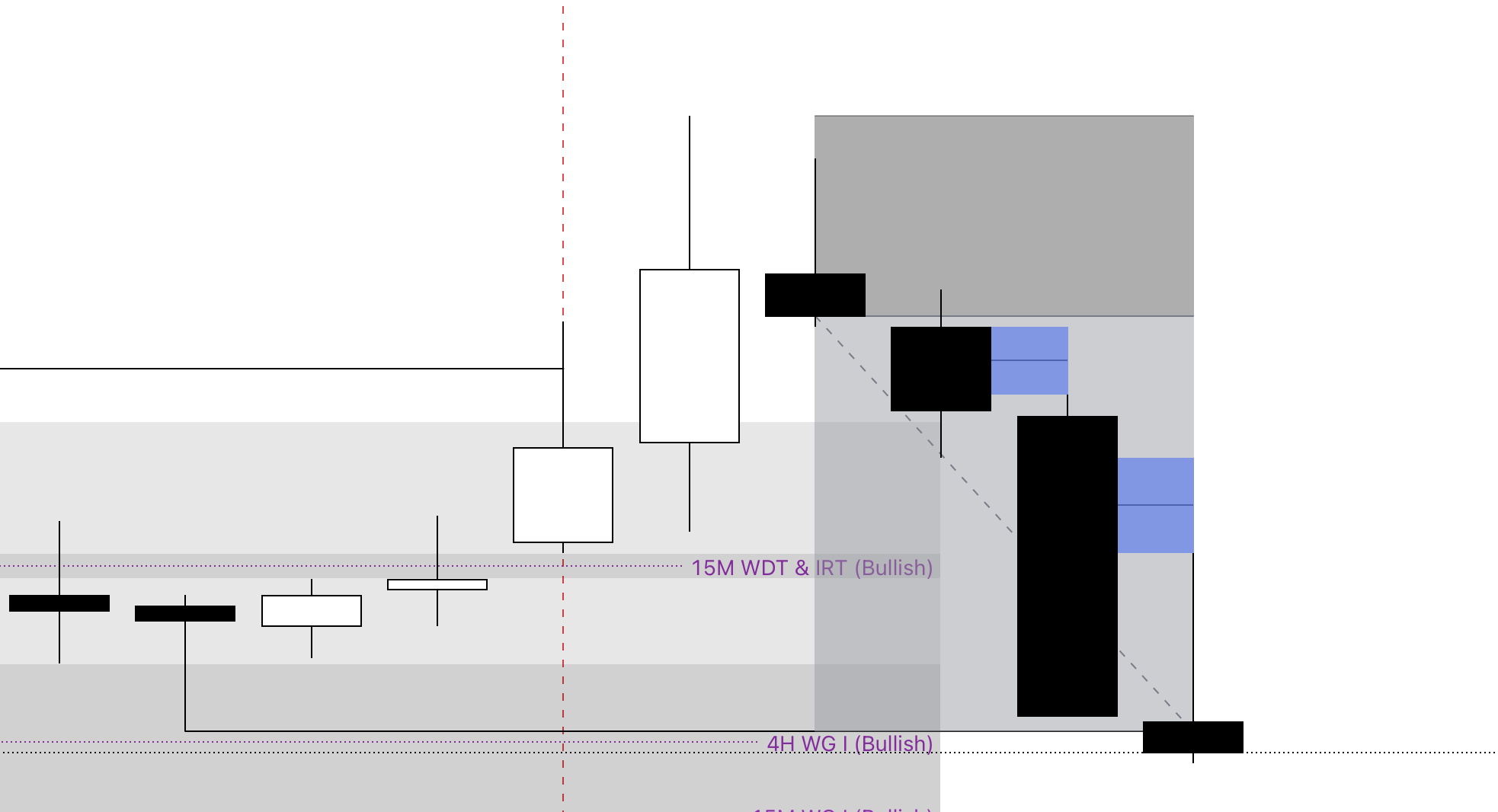

9/4/2024

Structure: Lack Of (Weekly & Below).

Structure of Weak Confluences:

- Majority Probable.

- 15M WG Inverse FVG.

- 15M WDT & IRT FVG.

- 4H WG Inverse FVG.

Initiation Liquidity: 15M Swing highs.

Supplementary Confluences: Inverse FVG’s.

Result: Valid confluence was sought & 2.08 R-Multiple.

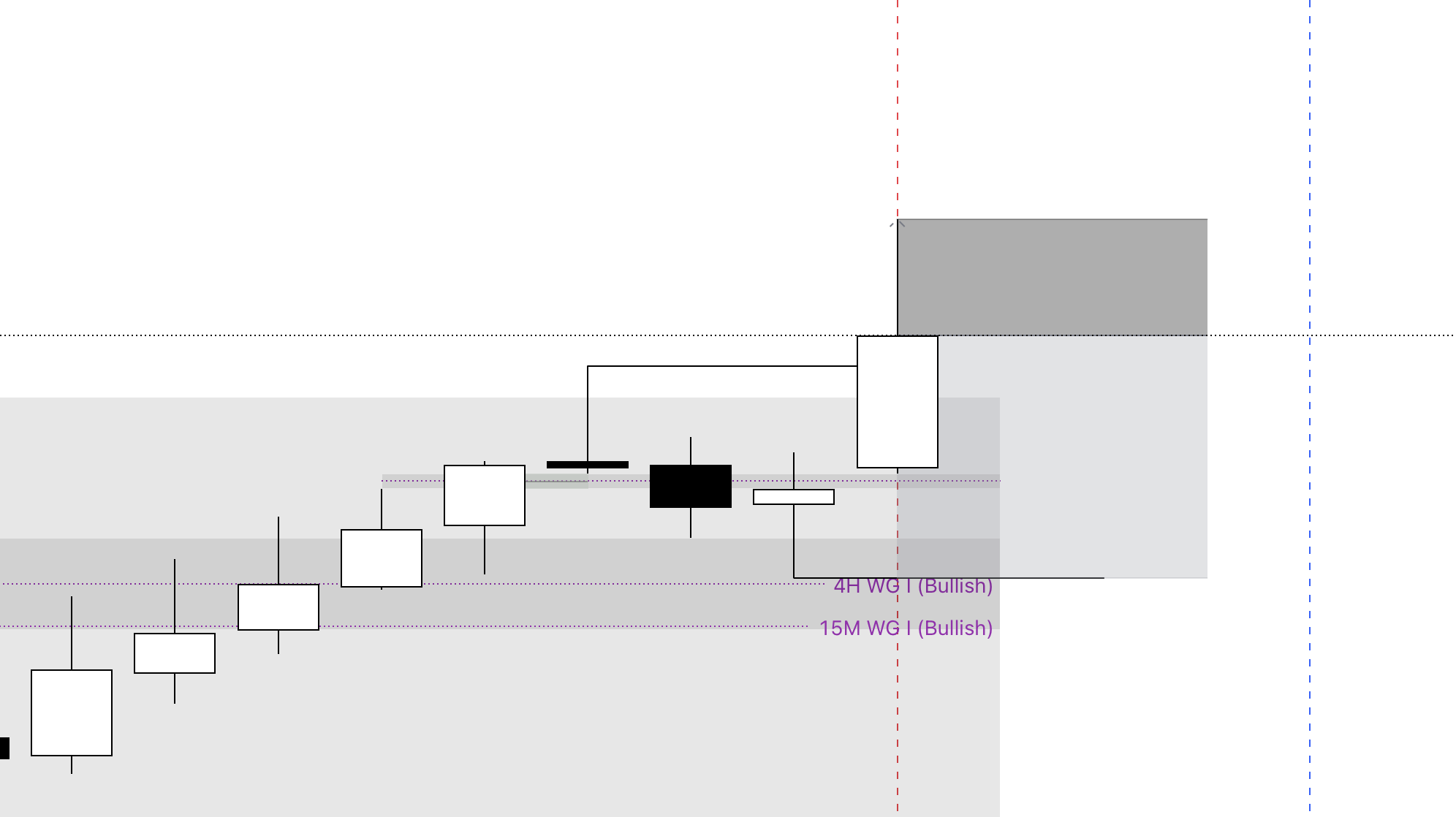

6/11/2024

Structure: Lack Of (Weekly & Below).

Result: The bearish confluence was sought & (1.66 R-Multiple).

Confluences: A 15M bearish inverse FVG above a bearish; 15M WG inverse FVG.

Close of Candle: Greater Than.

Timeframe of FVG: 15M.

Supplementary Confluences: Inverse FVG’s.

Initiation Liquidity: 15M Swing Lows.

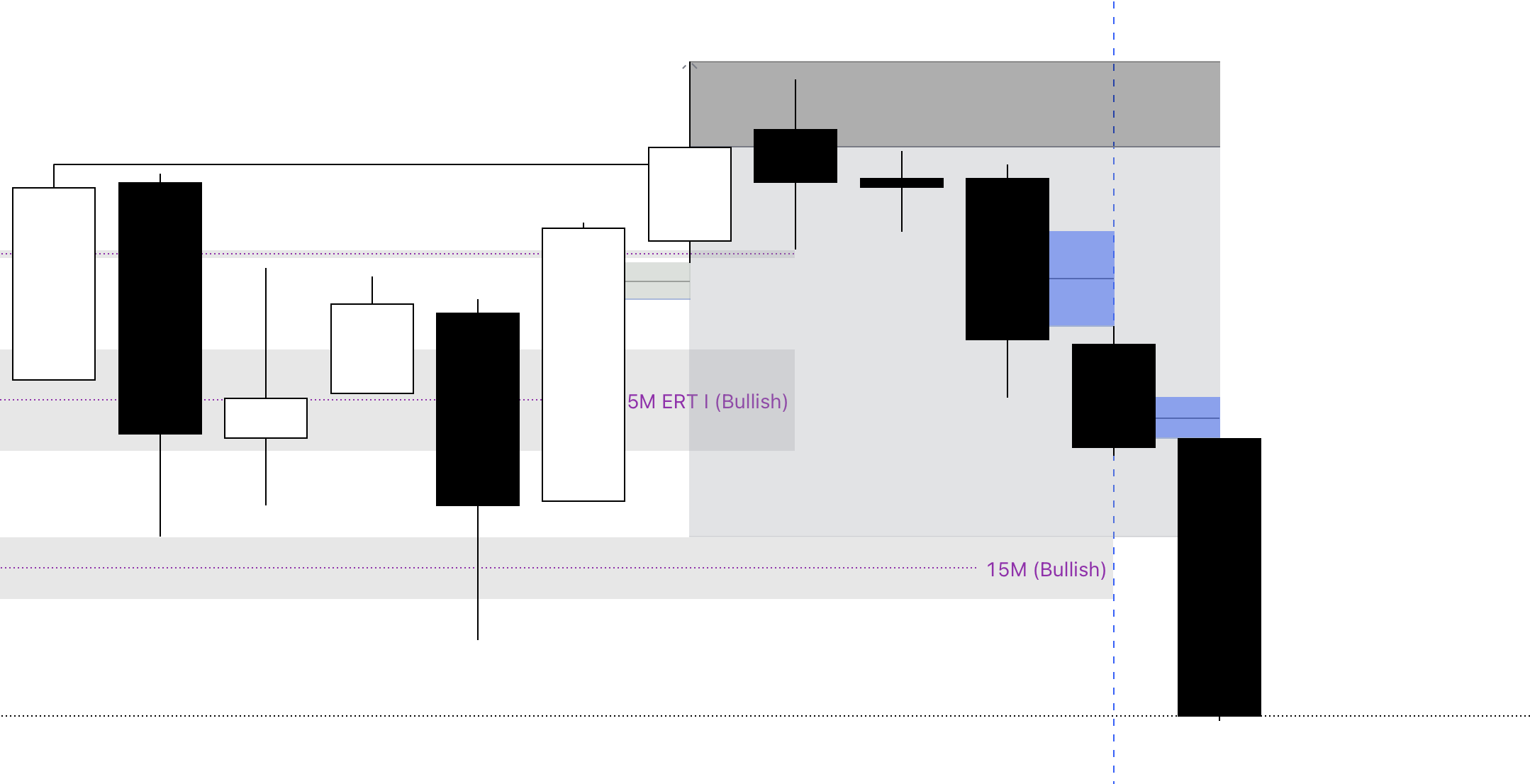

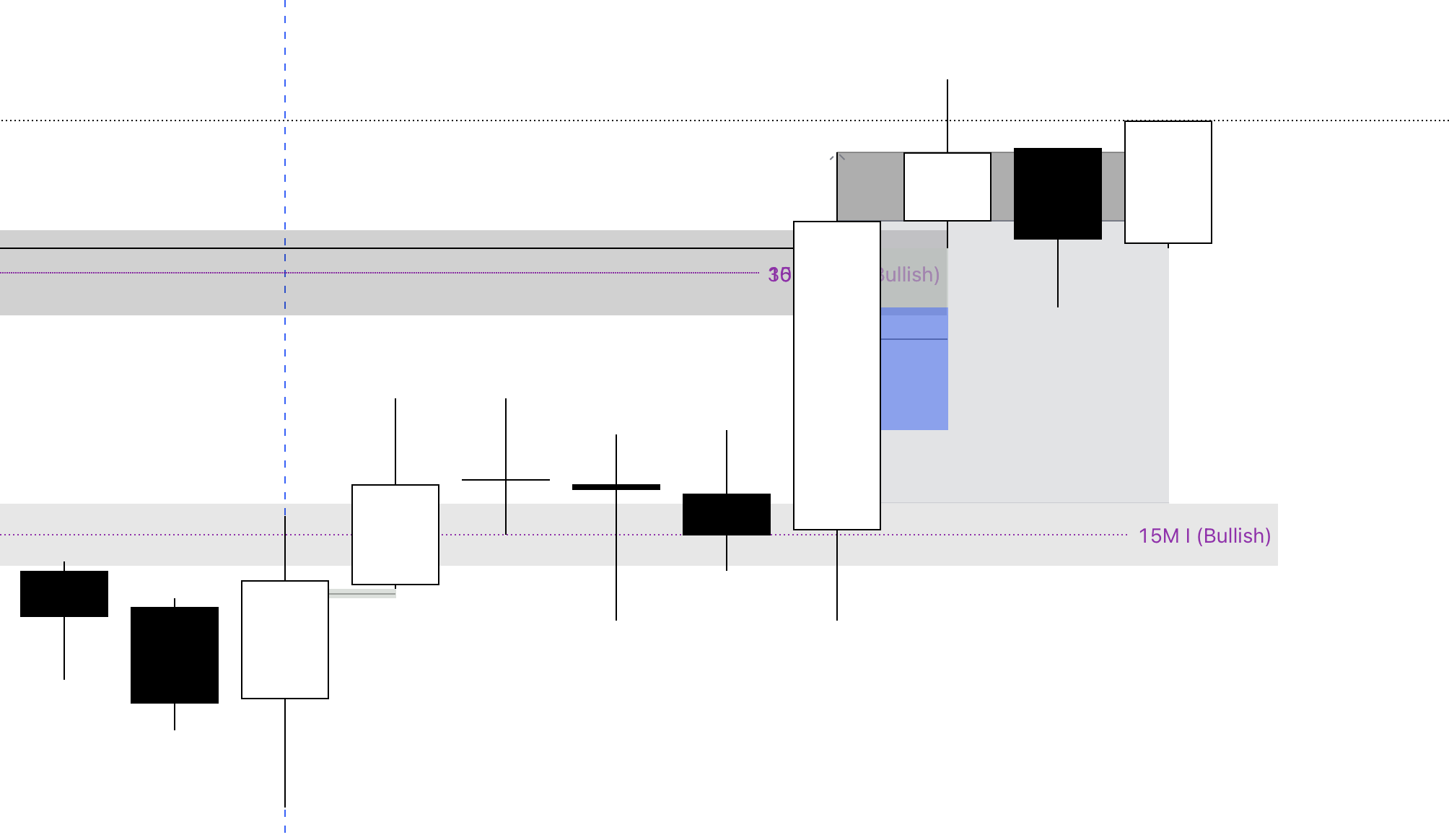

25/11/2025

Structure: Lack Of (Weekly & Below).

Result: The valid bullish confluence was sought & (4.58 R-Multiple).

Confluences: A 15M bullish FVG beneath a bullish; 15M ERT inverse FVG and 15M ERT inverse FVG.

Close of Candle:

Timeframe of Displacement:

- 15M ERT Inverse FVG: External.

- 15M ERT Inverse FVG: External.

Probable Confluences: 2/2.

- 15M ERT Inverse FVG.

- 15M ERT Inverse FVG.

Improbable Confluences:

Undefined Confluences:

Supplementary Confluences: Inverse FVG’s.

Initiation Liquidity: 15M Swing Highs.

DISPROVES

TOTALS: 2 & - 2.00 R-Multiple.

8/3/2024

Structure: Lack Of (Weekly & Below).

Result: Only the improbable confluences were sought & ( - 1.00 R-Multiple).

Confluences: A 15M bullish inverse FVG beneath a 15M WG bullish inverse FVG and 30M WG bullish inverse FVG at the same level.

Close of Candle:

- 15M WG Inverse FVG: Greater Than.

- 30M WG Inverse FVG: Greater Than.

Timeframe of Displacement:

Probable Confluences: 2/2.

- 30M WG Inverse FVG.

- 15M WG Inverse FVG.

Improbable Confluences:

Undefined Confluences:

Supplementary Confluences: Inverse FVG’s.

Initiation Liquidity: 15M Swing Highs.

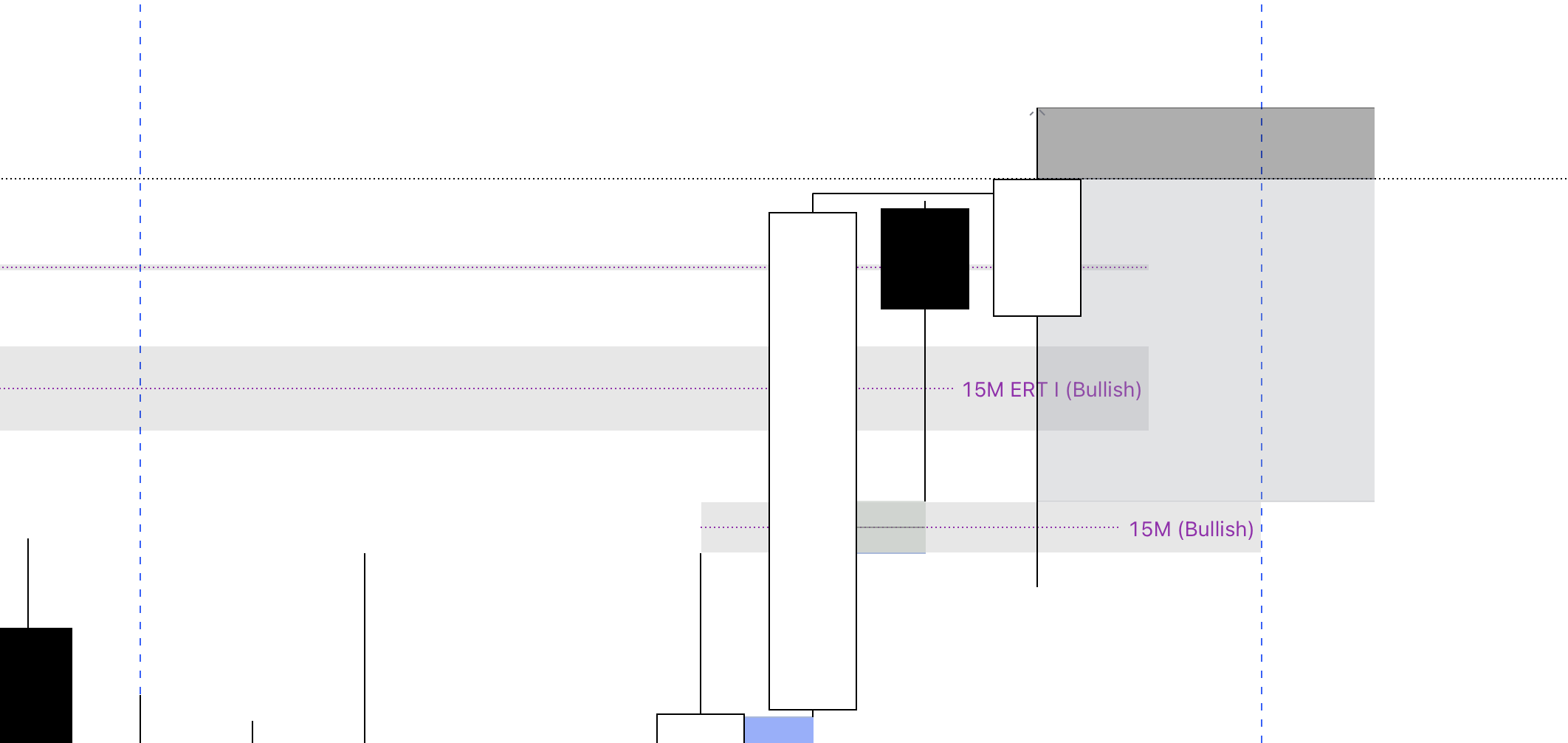

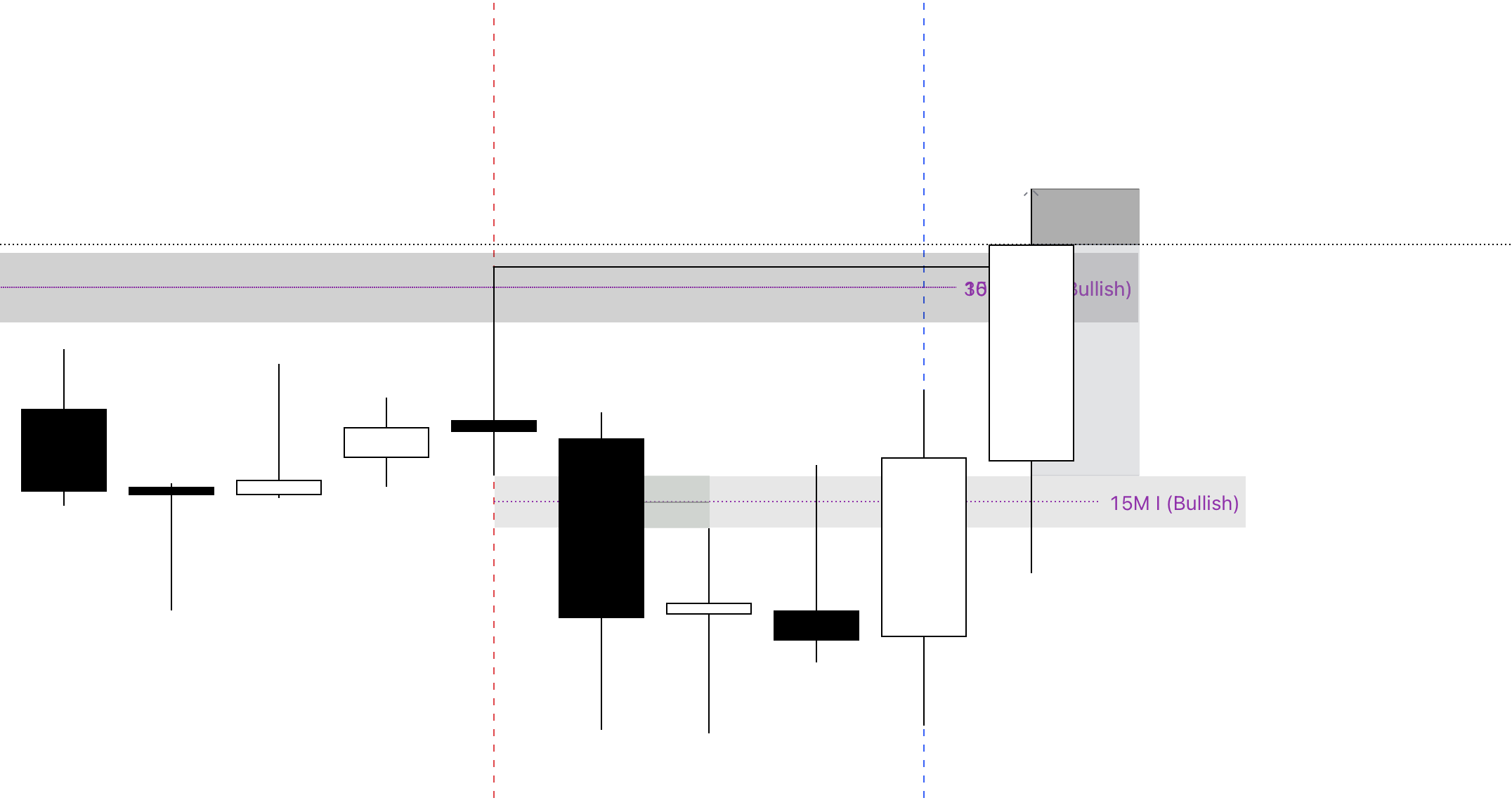

7/11/2023

Structure: Lack Of (Weekly & Below).

Result: No bearish confluences were sought & ( - 1.00 R-Multiple).

Confluences: A 15M bearish FVG within a 15M ERT bearish inverse FVG.

Timeframe of FVG: 15M.

Timeframe of Displacement: External.

Supplementary Confluences: Inverse FVG’s.

Initiation Liquidity: 15M Swing Lows.